Welcome to the definitive guide to saving money, a no-nonsense, easy-to-implement, and people-friendly guide to creating your financial future. Whether paycheck to paycheck or simply looking to better plan your finances, this guide has it all. We’ll discuss budgeting, wise spending, saving advice, and even tips from top money-saving books, all explained in real terms for real people with real lives.

Saving money is not all about pinching pennies. It’s about getting your money to work for you. With the right techniques, a straightforward plan, and regular habits, you’ll discover how to save money quickly and wisely without having to feel like you’re missing out on life. So, let’s get started and create your blueprint to financial peace and freedom.

Introduction to Smart Money Management

Why Learning How to Save Money Matters

Consider this: Would you rather worry about bills each month or be confident that you have a safety net to fall back on? That’s why knowing how to save money is so vital. It empowers you, not your bills, impulses, or the market.

When you begin saving money regularly, you create the opportunity for more: purchasing a home, beginning a business, world travel, or just sleeping more soundly at night. Financial freedom is what it’s all about. And the greatest part is this: anyone can begin saving, regardless of where you are now.

Saving is not deprivation. Saving is conscious expenditure, smarter choices, and realising that even small changes may contribute to impactful outcomes in the long run. Consider it strengthening your money muscles. It will be challenging in the beginning but the long run benefits are absolutely worth it.

Others wonder, “How can I save money if I don’t make much?” The solution is discipline, consistency, and planning, not merely income.

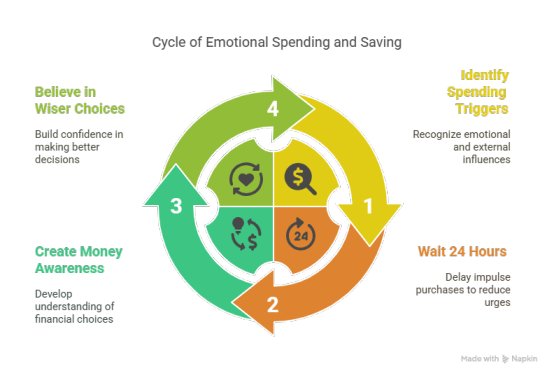

Understanding the Psychology Behind Spending Habits

Before you know how to save, you must know why you spend. Emotional spending, pressure from friends, and advertising really influence the way we manage our finances. You may swipe your card not due to a need but because you’re bored, stressed, or under social pressure.

Face it: purchases are made with emotions. You look at Instagram for one second; the next thing you know, you’ve purchased another gadget that you don’t need. Retail therapy is a good feeling in the short term but evokes regret afterwards.

The best part? You can substitute those habits with healthy saving rituals by identifying your triggers. Here’s what to do: the next time you feel like buying something on impulse, wait 24 hours. You’ll probably no longer feel the urge. Saving money begins in your head. Emotional sensitivity and financial planning are hand in hand. You don’t have to be a monk. You have to create money awareness and believe in yourself to make wiser choices.

Step 1: Set Your Financial Goals

Short-Term vs. Long-Term Goals

If you don’t have any idea where you’re heading, how can you possibly tell when you arrive? That is why goal-setting is the building block of money planning.

Short-term goals (within 1 year) might include:

- Building a $1,000 emergency fund

- Paying off a small credit card balance

- Saving for a weekend getaway

Long-term goals (1–5 years or more) might include:

- Saving for a house

- Paying off student loans

- Building retirement savings

Saving money becomes less intimidating by doing it this way. Please set down your goals, keep them handy, and read them each month. It keeps you inspired and on track.

Bonus tip: Apply the SMART principle to get your goals Specific, Measurable, Achievable, Relevant, and Time-bound.

How Financial Planning Helps Shape Your Future

Picture yourself driving to a new location without a map. You may eventually arrive, but you’ll be wasting time and gas. Budgeting is your GPS, keeping you on track, efficient, and focused. Look at your income and your expenses, then match them up with your objectives. Budgeting not only saves you money, but it teaches you how to save money every month on a scale that works for you.

You’ll feel more confident and in command. And your confidence builds the more you plan. When emergencies creep up on you (for they will), your plan stabilizes you and keeps you ready financially.

Keep in mind, financial planning is not just for the wealthy. It’s for anyone who needs to better manage their finances and put the paycheck-to-paycheck life behind them.

Step 2: Create a Realistic Monthly Budget

Budgeting Basics: Income vs. Expenses

Let’s discuss budgeting, or the road map to saving money. Simply put, a budget instructs your money where to go, so you’re not left scratching your head as to where it went.

Here’s a simple budgeting method that works wonders:

The 50/30/20 Rule

- 50% for needs (rent, food, utilities)

- 30% for wants (entertainment, eating out)

- 20% for savings and debt repayment

Begin by enumerating all sources of income. Next, list all monthly expenses. If your expenses outweigh your income, then it is time to make some changes. Budgeting is not a limitation. It’s authorization to spend wisely. When you give each dollar a task, you avoid impulse purchases and feelings of guilt later.

Still feel overwhelmed? Use budgeting apps like:

- YNAB (You Need A Budget)

- Mint

- PocketGuard

This way, you stay on top of your money-saving journey without crunching numbers all day.

Tools and Apps That Help You Budget Like a Pro

Due to technology, it’s no longer a requirement to be a financial guru to budget. These gadgets do the work for you:

- YNAB: Assist you in assigning money to all categories and motivates you to live on last month’s pay.

- Mint: Monitors spending, provides bill reminders, and offers individual saving advice.

- Goodbudget: Computer envelope budgeting system that’s perfect for visual learners.

- Spendee: Monitors shared home budgets and personal expenses.

- Zeta: Designed for couples, monitors joint expenses and financial targets.

All of these assist your budgeting and illustrate how to build a savings plan without anxiety. The less effort your tools require, the more likely you are to keep the habit up. And habits, not hacks, are what create sustainable financial freedom.

Step 3: Track Every Dollar You Spend

Why Tracking is Crucial in Money Management

One of the best methods of saving money is tracking your expenditure. It is easy to overspend without knowing where your money is being spent. By monitoring your expenditure closely, you are able to make better decisions and spot areas where you can reduce expenditure. This is a major aspect of budgeting and financial planning.

- Following your spending allows you to notice trends.

- It can point out where you are spending too much on unnecessary things.

- With tracking, you will be able to clearly see your finances, and you will know how much money you can save every month.

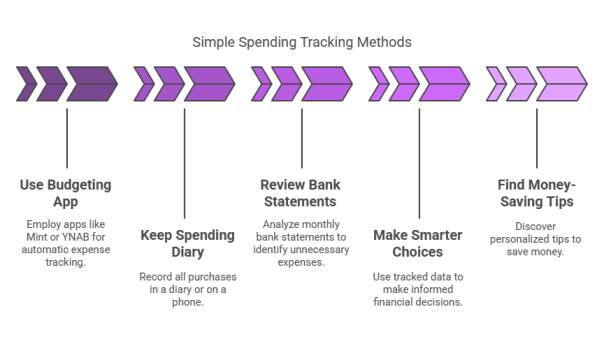

Easy Ways to Keep Track of Your Spending

Keeping track of your spending doesn’t have to be complicated. There are simple ways to do this, making it easier to stick to your money management goals.

- Use a budgeting app: Apps like Mint or YNAB (You Need a Budget) automatically track your expenses.

- Keep a spending diary: Write down every purchase you make. This can be done on your phone or in a notebook.

- Review bank statements: Review your bank statements at the end of each month to spot any unnecessary expenses.

By consistently tracking your spending, you’ll be able to make smarter choices and find easy money-saving tips that fit your lifestyle.

Step 4: Cut Unnecessary Expenses Without Sacrificing Joy

Identify and Eliminate Hidden Money Drains

Occasionally, we do not notice how fast little, nonessential expenses build up. Such “hidden money drains” might keep us from saving. Below is how you can identify them:

- Unused subscriptions: Review your subscriptions (such as streaming channels, magazines, or fitness centers). Unsubscribe from those which you do not use anymore.

- Dining out often: If you’re eating out too much, eat at home more often to cut costs.

- Impulse purchases: Steer clear of impulse purchases. Schedule your shopping trips to avoid going over your budget.

Cutting down on these costs enables you to direct your money towards your savings plan, taking you closer to your target of how to save money every month.

How to Save Money Each Month With Smart Choices

Saving money isn’t necessarily giving up on stuff you like. It’s learning to make smarter decisions with money. Here’s how to make it work:

- Shop smarter: Buy in bulk, use coupons, and shop during sales to cut costs.

- Automate savings: Create automatic transfers into your account so you’re saving money every month consistently.

- Switch to lower-cost options: For instance, switch to generic products from branded ones or cut down on utility consumption to minimize bills.

By implementing book money-saving strategies and paying attention to simple money-saving techniques, you can learn to save money as a habit without the deprivation.

Conclusion

Learning to save money and manage finances is a process that begins with baby steps. You can gradually increase your savings by monitoring your expenses, eliminating unnecessary expenses, and making better financial choices. Every little thing adds up, whether you are working on budgeting, planning finances, or searching for saving tips, so acting today can get you closer to your financial objectives.

Additional Tips to Save Money:

- Establish a savings plan: Determine how much you wish to save and set achievable goals.

- Research the best ways to save money fast: There are numerous quick-saving techniques, such as lowering your grocery bill or decreasing entertainment costs.

- How to save money every month: Make a list of monthly expenses and where you can save.

By doing all these little adjustments, you will soon notice just how simple it is to save money and sort out your finances!